September 6, 2025

Turn on revenue where users click 'Earn'

Add fees to any DeFi workflow with one line of code. Monetize Earn, Leverage, Trading, or Managed Portfolios instantly.

Turn on revenue where users click “Earn”

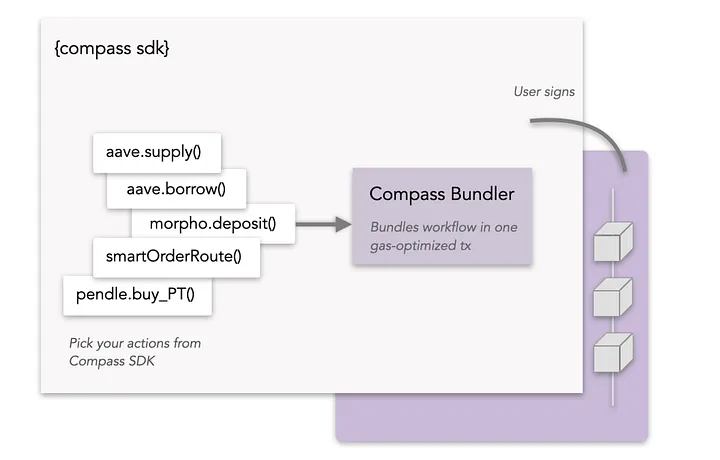

Compass lets you embed your fee (performance / withdrawal / deposit / etc.) inside the same transaction the user already signs. Paired with the Transaction Bundler, any multi-step DeFi flow becomes one atomic transaction.

What you get

- Day-one monetization: set and collect fees in-flow.

- Higher success: one step, fewer failures.

- Lower cost: typically 50–70% less network cost than multi-tx flows.

- Faster launch: no new contracts or audits.

What “fees in the payload” means

Add fee parameters to a bundled transaction (deposit, borrow, swap, rebalance). This means your fee is just another action in the DeFi workflow. When the user signs the transaction payload, the chain executes the workflow and your economics.

- Types: performance, withdrawal, deposit, management (or your own structure)

- Where: inside the same user-signed transaction

- Ops impact: no new contracts to deploy, no new risk, no audits

No extra contracts. No wrappers. No audits. Just add your fee as one line in the payload and you’re monetizing instantly.

Why this matters

- Revenue turns on instantly. You can launch Earn, Leverage, or Managed Portfolios and capture economics on day one.

- Margins improve at scale. Bundling typically cuts gas 50–70% and reduces failures, increasing realized APY and net revenue.

- Shorter build cycles. One interface across protocols (plus ERC-4626 vaults) → fewer bespoke code paths, faster iteration, lower maintenance.

Common use cases (pick any, combine many)

- Earn: deposit into yield vaults with your management/deposit/withdrawal fee in the same tx.

- Aave Leverage (long/short): borrow → swap → deposit repeat as one user step ; apply a performance or spread fee.

- Managed Portfolios (auto-rebalance): withdraw → swap → redeposit to target weights, with your fee applied at execution.

- Trading + Yield: route a swap then park idle balance into yield in a single, fee-aware transaction.

How it works (in 3 steps)

- Compose the workflow (e.g., approve → swap → deposit) using the Compass Transaction Bundler.

- Attach fee params to the payload.

- User signs once. The chain executes atomically and routes your fee.

Result: one step, your fee included, fewer failures, lower cost.

Who uses this

Fintechs, wallets, exchanges, and custodians that want to add Earn, Leverage, Trading, and Managed Portfolios without building fee infrastructure or complex multi-tx UX, and who want unit economics that improve as volume grows.

Ready to ship?

- Tutorial: Embed fees in a bundled transaction

- Background: Transaction Bundler overview

- Talk to us: contact@compasslabs.ai