April 30, 2025

The UX Breakthrough Crypto Has Been Waiting For

EIP-7702 lets wallets act like smart contracts. With Compass API, multi-step DeFi strategies collapse into one atomic transaction — faster, cheaper, safer.

The UX Breakthrough Crypto Has Been Waiting For

Author: Aidar Pochanov

Table of contents

- Introduction

- Pectra: A New Crypto Primitive

- What EIP-7702 Changes

- How EIP-7702 Works

- Real Example: Recursive Lending on AAVE

- What This Unlocks

- Get Started

Introduction

Crypto’s biggest challenge has never been the technology. It’s been usability.

The Pectra upgrade**(EIP-7702)** changes that. Wallets can now temporarily act like smart contracts, collapsing multi-step DeFi strategies , cross-chain transfers , and identity checks into a single transaction.

At Compass Labs, we built the first API that makes this breakthrough immediately available to developers. No Solidity, no custom infrastructure, just one API call.

If you’re building DeFi apps, wallets, on-chain trading platforms, or agentic workflows, Compass APIunlocks a new standard :

- Build complex DeFi flows without smart contracts and blockchain engineering

- Batch swaps, borrows, approvals and more — fully non-custodial

- Cut gas costs and reduce failure points

- Deliver true one-click execution to your users

Compass API turns what used to take months of engineering and ten transactions into one API call — cheaper to build, faster to ship, and radically better for users.

Read on to learn what Pectra is, how EIP-7702 works, and how to build in hours what used to take months.

TL;DR: Compass API lets you execute EIP-7702 batched transactions through one simple API call. Complex DeFi strategies, enterprise workflows, and programmable finance — all without smart contracts.

Pectra: A New Crypto Primitive

The Pectra upgrade to Ethereum introduces one of the most powerful primitives in crypto: letting wallets temporarily act like smart contracts.

This is a step-function improvement in blockchain UX. Multi-step operations — like recursive lending , active liquidity management, andconditional execution — that once required multiple approvals, transactions, and interfaces now execute atomically in a single action.

We’ve spent the last months working with the Ethereum Foundation to build the first API that makes this capability immediately accessible to developers. No Solidity required.

A new foundation for crypto apps.

What EIP-7702 Changes

Before Pectra, EVM-compatible chains feature two distinct account types:

- EOAs (regular wallets) could only send simple transactions

- Smart contracts could store or execute complex logic, but required deployment

This division means poor UX : it forced developers to create convoluted architectures that users found impossible to navigate.

EIP-7702 eliminates this boundary. EOAs can now temporarily behave like a smart contract, effectively making it possible to execute custom logic, batch actions, and optimize gas without the need to deploy a smart contract.

This shrinks what used to be 10+ interactions into one atomic action. It’s cheaper, safer, and a massive UX upgrade.

You don’t need a team of Solidity devs to ship DeFi logic anymore.

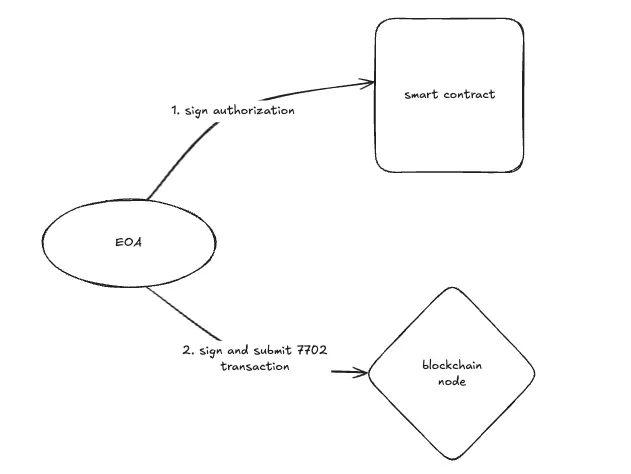

How EIP-7702 Works

The process of enabling code execution for an EOA under EIP-7702 involves two steps:

- Authorization : The user signs a cryptographic authorization allowing their EOA to temporarily adopt a deployed smart contract’s code.

- Transaction Execution : The user sends a self-targeting transaction that includes the signed authorization, enabling the EOA to execute with the borrowed contract logic while maintaining the security of the original account.

This elegant mechanism enables EOAs to perform complex operations like

transaction batching, conditional execution, and gas abstraction without

sacrificing security or requiring multiple contract deployments, fundamentally

expanding what’s possible within a single transaction.

How EIP-7702 works

Real Example: Recursive Lending on AAVE

Consider a high-yield recursive lending strategy using sUSDe on Aave:

Before EIP-7702

- Swap 100 USDC to sUSDe on Uniswap

- Supply sUSDe on AAVE

- Borrow USDC on AAVE against provided collateral

- Repeat steps 1–3 for higher leverage

For users, this means jumping between apps, wrestling with ABIs, waiting for confirmations, approving tokens repeatedly, parameter encoding, nonce sequencing, paying excessive gas, and risking costly mistakes at every step.

This is why crypto UX still feels broken.

With Compass API

Define the entire sequence in one, simple API call. Users sign once. Compass handles the complexity, building and returning a secure, EIP-7702-compatible transaction that runs your logic in a single step.

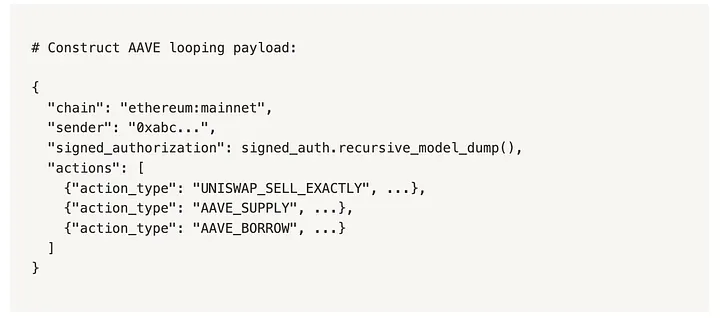

Step 1: Build Payload

# Construct AAVE looping payload:

{

"chain": "ethereum:mainnet",

"sender": "0xabc...",

"signed_authorization": signed_auth.recursive_model_dump(),

"actions": [

{"action_type": "UNISWAP_SELL_EXACTLY", ...},

{"action_type": "AAVE_SUPPLY", ...},

{"action_type": "AAVE_BORROW", ...}

]

}Step 2: Sign & Execute

# Sign EIP7702 transaction

signed_batch_tx = Account.sign_transaction(batch_tx, PRIVATE_KEY)

# Broadcast the transaction

tx_hash = w3.eth.send_raw_transaction(signed_batch_tx.raw_transaction)That’s it. One signature. One transaction. Full recursive strategy executed, fully non-custodial, with optimal gas efficiency.

What This Unlocks

With Compass API, complex on-chain strategies no longer need smart contracts, custom infrastructure, or multi-step user flows.

- 10x faster development — no Solidity needed

- Lower costs — fewer contracts, lower gas

- Fewer failure points — more reliable execution

- Simpler UX — complex workflows reduced to one click

What used to take months of engineering and weeks of UX work now happens with one API call.

Crypto infrastructure is finally catching up to what builders and users expect and need.