October 30, 2025

DeFi for Fintech: The Infrastructure Moment

Fintech transformed finance with apps. Now DeFi is transforming it again by turning blockchain into the invisible infrastructure powering the next generation of financial products.

From Apps to Infrastructure

Fintech won by making finance easier, accessible and user-friendly. Mobile apps brought payments, investing, and lending to millions.

Then the industry evolved. Financial services stopped just being standalone apps and started embedding everywhere. Shopify merchants access capital through their dashboard. Uber drivers get instant payouts. Finance became infrastructure.

The same thing is happening with crypto. What started as experimental technology is becoming the infrastructure layer for global finance. Protocols now process billions daily, handling lending, trading, and payments through automated systems that run 24/7. Stablecoins power $46 trillion in annual transactions, rivaling Visa's volume. Yet many haven't integrated because blockchain remains complex.

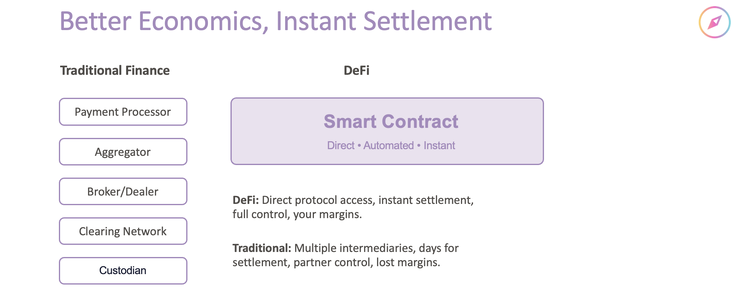

Why DeFi Changes the Economics

Smart contracts remove intermediaries. Traditional finance stacks fees and complexity at every layer: payment processors, brokers, clearing networks, custodians. DeFi uses automated code that executes transactions without middlemen. Result: better margins for you, better products and rates for customers.

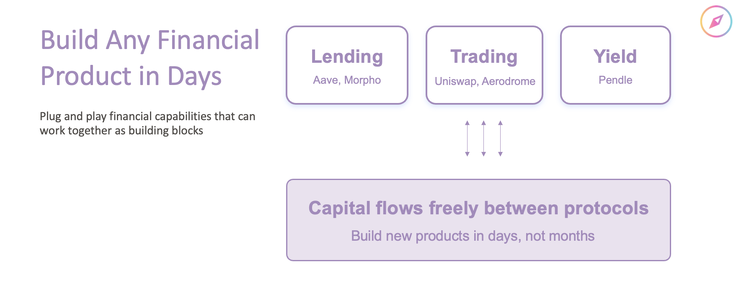

Protocols act as financial building blocks. Each protocol does one thing well—lending (Aave, Morpho), trading (Uniswap), yield (Pendle)—and they work together seamlessly. Plug them in like Lego pieces. Capital moves freely between them: lent in one, traded in another, all programmatically.

This composability makes money work harder and creates an entirely new class of financial products. The same asset can earn while offering instant credit borrow, and traded without ever leaving the system.

Speed by default. Multi-day settlement made sense in a world of paper checks. Customers expect instant everything. DeFi delivers this by default with instant settlement and 24/7/365 availability, regardless of time zones, holidays, or business hours.

Global reach. DeFi infrastructure works the same everywhere. Launch in Mexico, Brazil, and the Philippines simultaneously without separate banking integrations or local banking relationships in each market.

DeFi collapses the cost structure of finance. It replaces intermediaries with code, turns liquidity into a shared network, and lets fintechs build better products than ever before.

The Market Opportunity

The numbers tell the story:

- Stablecoins reached mainstream scale. $46 trillion in annual transaction volume, up 106% year-over-year. More than 1% of all U.S. dollars now exist as tokenized stablecoins. They're the #17 holder of U.S. Treasuries with over $150 billion. That is more than many sovereign nations.

- Infrastructure scaled dramatically. Blockchains now process 3,400 transactions per second, up 100x in five years. Transaction costs on Ethereum L2s dropped from $24 in 2021 to under $0.01 today.

- Institutional moved in. Over $175 billion sits in Bitcoin and Ethereum ETPs, up 169% year-over-year. Circle, Robinhood, and Stripe are developing new blockchains. Companies with massive distribution are bringing payment flows onchain.

- Regulatory shift. The GENIUS and CLARITY Acts unlocked momentum. Mentions of stablecoins in SEC filings grew 64% since legislation passed.

DeFi is no longer speculative - it’s becoming the global financial backend.

The Infrastructure Gap

The opportunity is massive, but untapped: 716 million people own crypto. Only 40-70 million use it onchain. People don't want to learn smart contracts or gas optimization. They want what crypto delivers: better banking features, 24/7, across the globe.

But blockchains are hard to work with; unfamiliar vocabulary, architecture patterns, and security requirements. Building products requires specialized expertise most teams don't have. This challenge multiplies with multiple products. Savings, credit, and trading need coordination across protocols and chains.

Building in-house costs $1-2M and takes over a year.

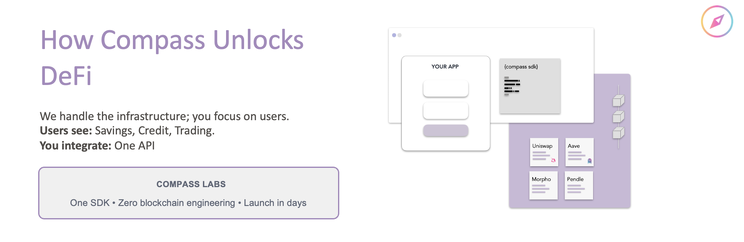

Fintechs need a backend that makes DeFi accessible without the blockchain burden.

Compass Labs as the DeFi backend

Compass Labs builds the infrastructure that makes DeFi integration practical, easy and fast.

One SDK provides lending, trading, yield, leverage, and monitoring across protocols and chains. We handle protocol integrations, wallet orchestration, embedded fees, gasless transactions, and multi-chain support. All through a non-custodial architecture. This eliminates unnecessary smart contract deployments, blockchain engineering, complex database reconciliation, and infrastructure maintenance. You build the products your customers want, control the UI, and keep your brand. Launch yield accounts today. Add credit lines next month. Trading after that. All on the same SDK.

Example: A remittance app integrates Compass. Users can now earn 8% on idle balances, borrow against holdings, and swap currencies. The app earns millions in new revenue with zero blockchain developers.

Making the blockchain invisible

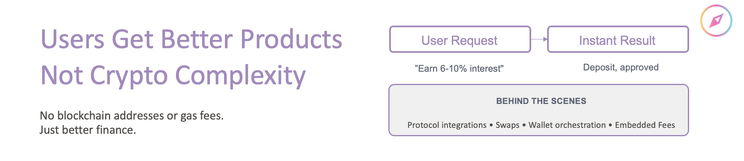

The best integrations are invisible. Users never see blockchain addresses or gas fees. They experience faster, better financial products.

Someone needs liquidity but won't sell Bitcoin. They take out a loan. Compass handles everything behind the scenes. They see instant approval and competitive rates. Their holdings keep earning yield. No crypto terminology.

Users see competitive returns on savings. Behind this, deposits flow through battle-tested lending protocols where borrowers generate interest. The technical infrastructure stays hidden.

This is the pattern successful fintechs follow: combine DeFi's capabilities with thoughtful product design. Users get better products. You get new revenue. The blockchain is invisible.

What Happens Next

Finance is converging on infrastructure that’s automated, transparent, and global. DeFi delivers this natively.

The first companies to deliver seamless multi-product DeFi experiences will capture market share: not by building "crypto features," but by using crypto infrastructure to build fundamentally better financial products.

With regulatory clarity and institutional adoption accelerating, the infrastructure is ready. Compass removes the integration barrier so you can focus on building great products. The blockchain complexity stays in our APIs.

Ready to explore what DeFi infrastructure can do for your product?

Glossary

Blockchain – A distributed digital ledger that records transactions across multiple computers. Think of it as a shared database that no single entity controls.

Smart Contract – Self-executing code on a blockchain that automatically performs actions when specific conditions are met, like a vending machine that releases a product when you insert the correct amount.

DeFi (Decentralized Finance) – Financial services built on blockchain technology that operate without traditional intermediaries like banks, using automated protocols instead.

Protocol – A set of rules and standards that govern how a DeFi application works. Protocols are like apps, but they run automatically on blockchains.

Stablecoin – A cryptocurrency designed to maintain a stable value, typically pegged to a currency like the US dollar (e.g., USDC, USDT).

Layer 2 – Technologies built on top of main blockchains to make transactions faster and cheaper while maintaining security.

Non-Custodial – An approach where users or companies maintain direct control of their assets rather than trusting a third party to hold them.

Yield – Returns earned on crypto assets, similar to interest in traditional finance, often generated by lending assets to borrowers in DeFi protocols.

Composable – The ability to combine different DeFi protocols and services like building blocks, creating new products by connecting existing components.

Lending / Borrowing Protocols – Platforms such as Aave or Morpho that let users lend assets to earn interest, or borrow against their holdings as collateral.

Collateral – Assets pledged as security for a loan in DeFi. If the borrower’s position falls below a threshold, the collateral is automatically sold to repay the loan.